For intended parents embarking on their surrogacy journey, understanding insurance coverage is crucial for both financial planning and peace of mind. This comprehensive guide explores the complex landscape of surrogacy insurance options and helps you make informed decisions about your coverage needs.

Feel free to watch our webinar that covers the different elements listed above:

Understanding Medical Expenses in Surrogacy

Core Medical Procedures

- In-Vitro Fertilization (IVF): Including egg retrieval, sperm collection, and embryo creation

- Embryo Transfer: The process of transferring the created embryo to the surrogate

- Fertility Medications: Hormones and other medications needed throughout the process

- Egg Donation Services: If required, including donor screening and compensation

- Egg Freezing: Storage and preservation of genetic materials

Pregnancy-Related Expenses

- Prenatal Care: Regular check-ups, ultrasounds, and genetic testing

- Labor and Delivery: Hospital stays and medical procedures

- Postnatal Care: Recovery and follow-up appointments

- Potential Complications: Coverage for conditions like:

- Gestational diabetes

- Preeclampsia

- Multiple pregnancies

- Postpartum care

- Mental health support

Insurance Coverage Options Explained

The following video sums up the context of insurance in surrogacy:Traditional Health Insurance Considerations

Policy Review

- Examine exclusions and limitations specifically related to surrogacy

- Understand network restrictions and out-of-network coverage

- Review lifetime maximums and annual caps

- Check for specific surrogacy exclusion clauses

Common Coverage Gaps

- Most policies exclude IVF treatments

- Egg donation services often require separate coverage

- Surrogate-specific procedures may be excluded

- Pre-existing conditions may affect coverage

Specialized Surrogacy Insurance Solutions

Insurance Riders

- Additional coverage specifically for surrogacy

- Usually time-limited to pregnancy duration

- May include specific benefits for complications

- Often more cost-effective than separate policies

Dedicated Surrogacy Insurance Plans

- Global Coverage Options

- Universal Family Insurance ($4,200–$10,350 premium range)

- Comprehensive maternity liability coverage

- Protection against complications

- Often includes newborn care

- Short-Term Policies

- ART Risk solutions (approximately $2,400)

- Focused coverage during critical periods

- May offer more flexible terms

- Often more affordable than full-term options

Supplemental Coverage Options

- Secondary insurance for gaps in primary coverage

- Specific procedure coverage (e.g., separate IVF insurance)

- Complications insurance

- Life insurance considerations

Feel free to watch our webinar that covers the different elements listed above:

Strategic Planning for Insurance Coverage

Before Starting Your Journey

Assessment Steps

- Review current insurance policies in detail

- Calculate potential out-of-pocket expenses

- Consider both best-case and worst-case scenarios

- Consult with insurance specialists familiar with surrogacy

Documentation Needs

- Gather all policy documents

- Request detailed benefits explanations

- Document all communications with insurance providers

- Keep records of all medical expenses

Cost Management Strategies

Network Optimization

- Choose in-network providers when possible

- Negotiate rates for out-of-network care

- Coordinate between multiple insurance policies

- Consider travel costs for in-network care

Financial Planning

- Set aside funds for deductibles and co-pays

- Plan for unexpected expenses

- Consider financing options for gaps in coverage

- Explore cost-sharing arrangements with agencies

Special Considerations

International Surrogacy

- Cross-border insurance implications

- Coverage in different jurisdictions

- Travel insurance requirements

- International healthcare system navigation

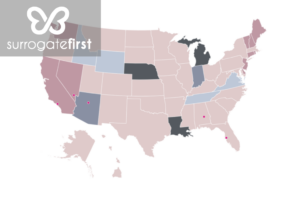

Legal Requirements

- State-specific insurance mandates

- Required coverage minimums

- Contractual insurance obligations

- Liability considerations

Making the Right Choice

Selecting the appropriate insurance coverage for your surrogacy journey requires careful consideration of multiple factors:Financial Capacity

- Available budget for premiums

- Ability to cover deductibles

- Emergency fund availability

- Long-term financial planning

Risk Tolerance

- Comfort with coverage gaps

- Willingness to self-insure certain aspects

- Balance between premium costs and coverage

Specific Needs

- Medical history considerations

- Geographic location

- Preferred medical providers

- Timeline for surrogacy journey

Moving Forward

Working with experienced surrogacy professionals can help navigate these complex insurance decisions. Consider consulting with:- Insurance specialists familiar with surrogacy

- Surrogacy agencies with insurance expertise

- Legal professionals specializing in reproductive law

- Financial advisors with family planning experience

Why SurrogateFirst?

At SurrogateFirst, we’re more than a matching agency—we’re your support system.

- Compassionate, personalized matching

- 24/7 access to dedicated case managers

- Legal and medical coordination

- Transparent pricing

- Emotional support for surrogates and for intended parents alike