The context of surrogacy financial challenges

Surrogacy is a remarkable path to parenthood, but for many intended parents (IPs), the financial challenges can be a significant hurdle. This article explores the key financial challenges IPs face during their surrogacy journey, along with potential solutions and insights to help them navigate these obstacles.

1. The Need for Comprehensive Financial Preparation

One of the first and most daunting challenges intended parents face is the requirement to be fully financially prepared before beginning the process. In the United States, the cost of surrogacy typically ranges between $150,000 and $200,000. This is a huge amount of funds to invest at one time, and often comparable to buying a home in many cases.

Why is being fully funded before starting your surrogacy journey considered best practice?

This requirement ensures that the surrogacy process can be completed without the risk of running out of funds. The surrogate must be never put in a position where she has to pay out-of-pocket or incur debt for medical expenses or other costs related to the surrogacy. The assurance that the entire journey is fully funded protects all parties involved.

To safeguard these funds, IPs should find a reputable escrow company to manage all associated costs. The escrow company distributes the funds according to the terms outlined in the legal contract. This provides peace of mind to all parties.

Insurance is also a must have in the process to ensure the safety of all parties involved. A dedicated article covers what you should consider when it comes to surrogacy insurance.

2. Limited Financing Options

For many, accumulating the entire cost of surrogacy upfront is a significant challenge. (You can work out your estimate with the surrogacy calculator (free).) Unlike other major life investments, such as purchasing a home, there are few established financing options available for surrogacy. As a result, intended parents often find themselves exploring alternative financing methods, including personal lines of credit, borrowing from friends and family, or even crowdfunding through platforms like GoFundMe.

Unfortunately, the market for financing family planning, particularly surrogacy, is not well-developed. However, there are specialized lenders who offer financial support tailored to the unique needs of intended parents. Some of these options include:

- CapEx MD: A specialized lender offering loans specifically for fertility treatments, including surrogacy. Find out more about CapEx MD financing here.

- New Life Fertility Finance: Provides a range of financing options for intended parents, focusing on fertility and surrogacy. Find out more about New Life Fertility Finance here.

- Sunfish: Another lender that offers financial solutions designed to assist with the costs of surrogacy. Find out how Sunfish may be able to help here.

Additionally, while limited, there are scholarship and sponsorship opportunities available. For example, the organization Men Having Babies (MHB) offers financial assistance programs that can help reduce the financial burden on intended parents. Exploring these options can provide much-needed relief in financing a surrogacy journey.

3. Lack of Benefits in Private and Government Sectors

In recent years, there has been significant progress in recognizing and supporting women’s reproductive health, particularly with the inclusion of egg freezing and IVF treatments. However, in corporate benefits packages, surrogacy benefits have not kept pace. As a result, surrogacy intended parents often find themselves shouldering the full financial responsibility.

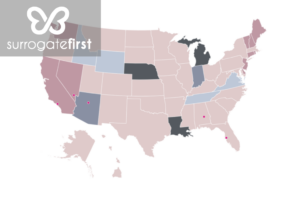

The good news is that awareness and inclusion of surrogacy as a viable family planning option are on the rise. The American Society for Reproductive Medicine (ASRM) has broadened its definition of infertility to include same-sex couples and single individuals. This has opened up new possibilities for intended parents to access medical benefits. In many states, infertility benefits are becoming mandatory for employers to offer. As a result, this a trend that may eventually become federal law, further increasing access to benefits for both private and government sector employees.

Large corporations are also beginning to offer surrogacy benefits as a way to attract and retain top talent, which is promising for intended parents. However, the lack of widespread benefits remains a challenge that needs to be addressed.

Conclusion

The surrogacy financial challenges can be a significant barrier for many intended parents. However, the landscape is gradually improving, with more options and support becoming available. By being fully financially prepared, exploring specialized financing options, and advocating for greater inclusion of surrogacy benefits in employer and government policies, intended parents can make their dream a reality.

If you’re ready to take the next step in your surrogacy adventure, reach out to our compassionate team. We’re here to support you, answer your questions, and help you navigate this extraordinary path to parenthood. Your dream of becoming a parent is within reach – let’s embark on this beautiful journey together.

Why SurrogateFirst?

At SurrogateFirst, we’re more than a matching agency—we’re your support system.

- Compassionate, personalized matching

- 24/7 access to dedicated case managers

- Legal and medical coordination

- Transparent pricing

- Emotional support for surrogates and for intended parents alike